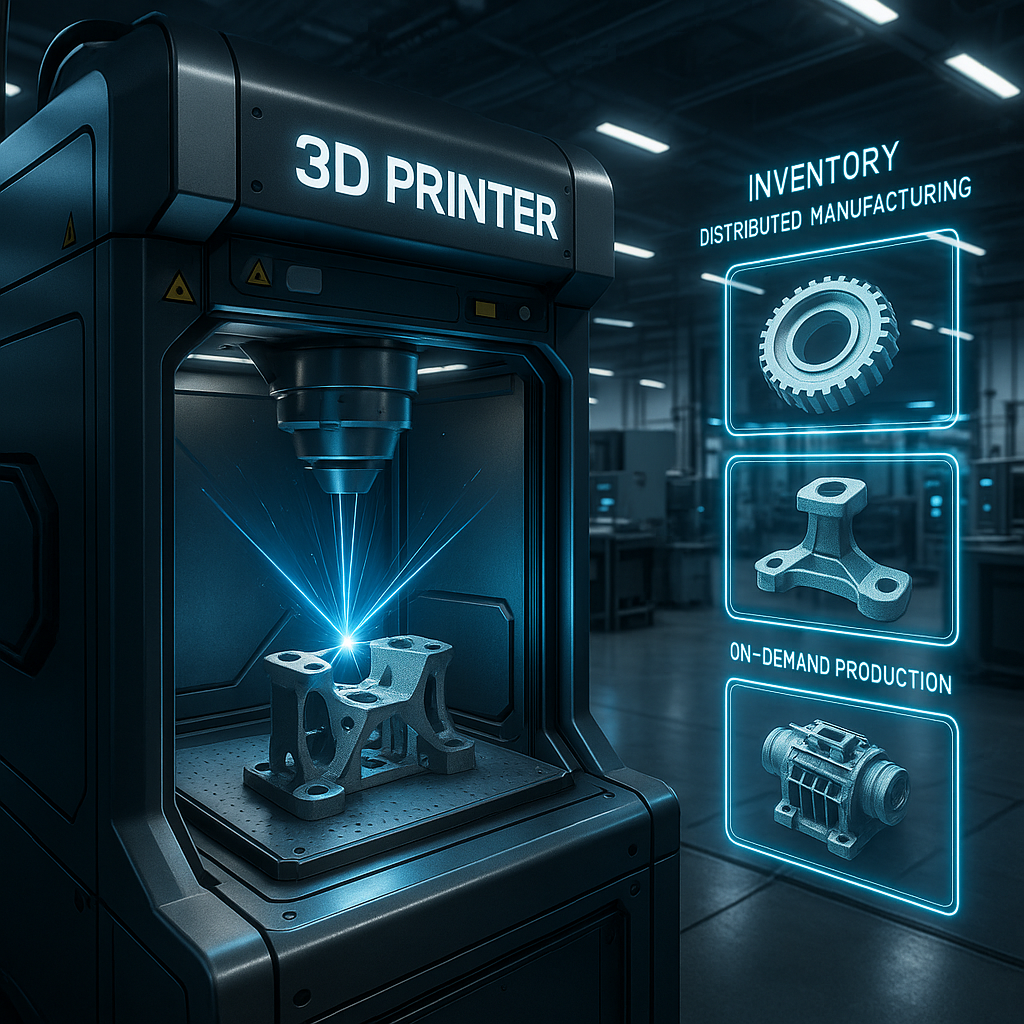

According to a recent South Bend Tribune article, a metal 3D printing manufacturer has recently expanded its technological capabilities, marking a significant milestone in advanced manufacturing. This development not only enhances the company’s product portfolio but also has broader implications for the growing trend of distributed manufacturing and digital inventory management.

What Happened

The manufacturer, whose identity and specific technologies remain undisclosed in public sources, has broadened its metal additive manufacturing capabilities. While detailed information about the new technologies or processes introduced is not fully available, the expansion likely involves improvements in print speed, material variety, or precision. This strategic move positions the company to better serve industries requiring complex metal parts with shorter lead times.

Why It Matters

This advancement is pivotal for the distributed manufacturing model, where production is decentralized and closer to end users. Metal 3D printing’s ability to produce parts on demand reduces the need for large physical inventories, enabling companies to maintain digital inventories instead. Digital inventories are virtual repositories of 3D printable part files that can be produced anywhere at any time, drastically cutting storage costs and supply chain vulnerabilities.

In sectors like aerospace, automotive, and defense, where metal components are critical and supply chain disruptions can be costly, the ability to print parts locally on demand offers resilience and agility. This expansion signals that metal 3D printing is moving closer to mainstream adoption for these applications, potentially transforming how manufacturers approach inventory and production logistics.

Technical Context

Metal additive manufacturing typically involves processes like powder bed fusion, directed energy deposition, or binder jetting. Each method has trade-offs in terms of speed, resolution, material properties, and cost. The recent expansion likely includes enhancements in one or more of these areas, such as faster build rates, improved surface finish, or expanded material compatibility including high-strength alloys.

Moreover, integrating advanced software for part design, simulation, and process control is crucial for consistent quality and repeatability. The move towards more robust, scalable metal 3D printing platforms supports digital inventory strategies by ensuring that parts produced on demand meet stringent performance standards.

Near-term Prediction Model

Given the current trajectory, metal 3D printing technology is in the Commercial maturity stage, with ongoing pilot projects and early adopters in critical industries. Over the next 12 to 24 months, we expect accelerated adoption driven by supply chain pressures and cost reductions in metal additive manufacturing equipment and materials.

The impact score for this expansion on distributed manufacturing is estimated at 75 out of 100, reflecting significant but not yet universal influence. Confidence in this prediction is moderate at 70, due to uncertainties around scalability and cost-effectiveness at mass production levels.

What to Watch

- Material and Process Innovations: New metal alloys and faster printing processes that can deliver parts with enhanced mechanical properties and reduced costs.

- Software Integration: Advances in digital inventory management platforms that enable seamless part file transfer, version control, and quality assurance.

- Supply Chain Adoption: How industries like aerospace and automotive incorporate metal 3D printing into their procurement and maintenance workflows.

- Regulatory and Certification Developments: Standards for metal 3D printed parts to ensure safety and performance compliance.

- Cost and Scale Improvements: Reduction in equipment and material costs to make on-demand metal part production economically viable at scale.

While some specifics about the manufacturer’s new capabilities remain unknown, this expansion is a clear indicator that metal 3D printing is becoming a cornerstone technology for distributed manufacturing and digital inventory solutions. Stakeholders should monitor technological progress and market adoption closely to capitalize on the emerging opportunities.